The most convenient financing for companies.

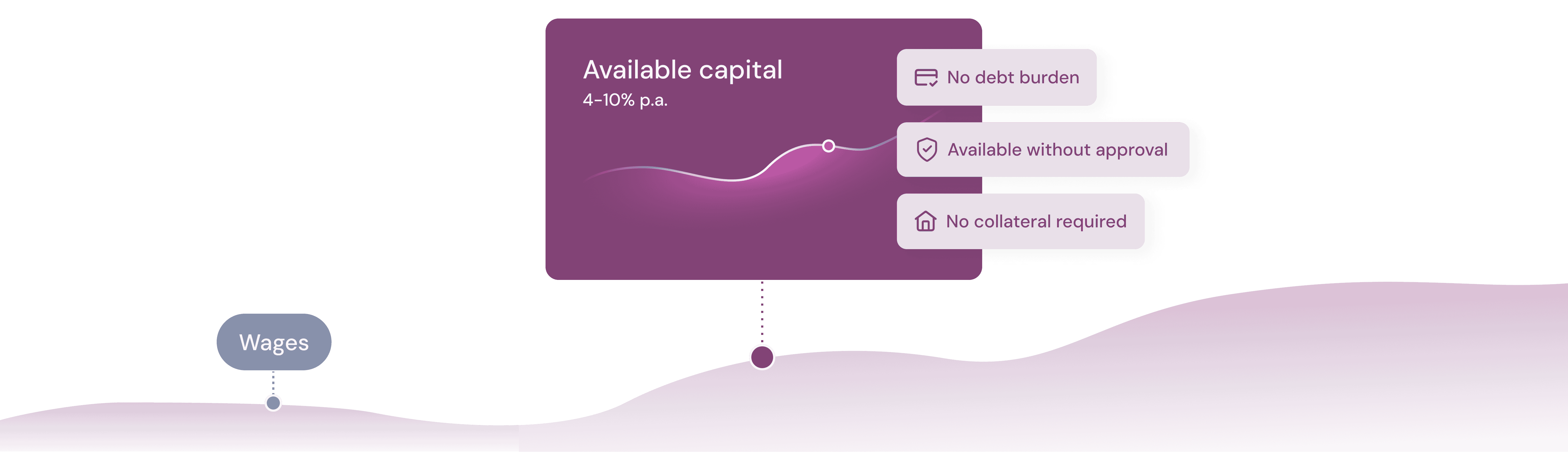

No debt burden, no collateral, no approvals needed

No debt burden, no collateral, no approvals needed

Our capital is helping these clients grow

How much capital can you unlock with WageNow?

We’ll pay your employees’ wages, giving you access to capital. No debt burden. With the best terms on the market.

Available working capital

*Prices in the table are based on a 6% annual interest rate (0.5% monthly).

The fee may vary depending on the client, ranging from 4–10% p.a. or 0.33–0.83% monthly.

Get the most convenient capital.

Contact us and we’ll create a tailored offer for you.

Financing comparison for companies.

Comparison of available financing options for SMEs based on annual interest rates.

| Overdraft | Bank loan | Factoring | ||

|---|---|---|---|---|

| Cost of capital | 4–10% p.a. depending on the client | 12–19.9% p.a. + fees for unused credit | 5.99–14% p.a. depending on creditworthiness | 6–20% p.a. – 1.5–5% of invoice value |

| Availability | For all companies with at least 20 employees | Company history required, from a certain revenue level | Based on company history and revenue | Available – terms depend on revenue and creditworthiness |

| Accounting classification | Not a loan – it’s a short-term claim | Short-term debt (if used) | Long-term debt (depending on maturity) | Short-term debt |

| Collateral & verification | No collateral, no checks, no approvals | May be required – depends on client’s creditworthiness | Yes – real estate, machinery, or other assets | No – secured by receivables |

| Tax optimization | Yes | N/A | N/A | N/A |

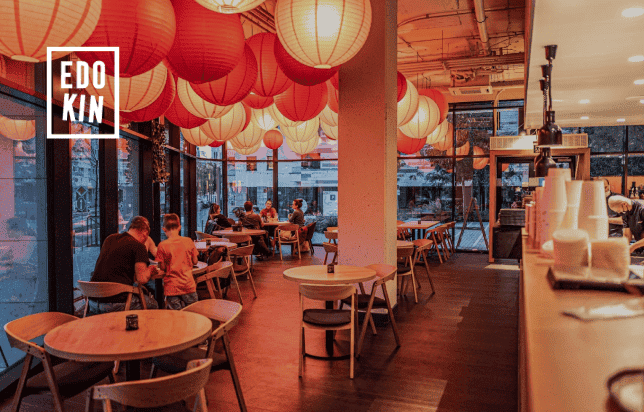

Client experience and testimonials

Our financing helps to grow these clients

I’m very satisfied with WageNow’s services. I appreciate their excellent communication – they always respond promptly to questions and are willing to help The financing was a great support for us. We received capital when we needed it the most. I definitely recommend them.

– Cindy Offermanová, COO of EDOKIN Restaurants

Spoločnosť Váš Lekár má možnosť spolupracovať so spoločnosťou WageNow v oblasti financovania a radi by sme vyjadrili našu spokojnosť s poskytovanými službami. Naša spolupráca priniesla významné zlepšenia v našom cash flow riadení. Financovanie nám umožnilo rýchly prístup k finančným prostriedkom, čím sme mohli flexibilnejšie a efektívnejšie riešiť naše mzdové finančné kalkulácie.

– Denisa Andelková, HR specialist of Váš Lekár

Working capital within 7 days

We understand that speed and access to capital are key for SMEs.

Contact us

- How many full-time employees do you have (excluding temporary workers and contractors)?

- What are your costs for net wages?

- Are you interested in stable or seasonal financing?

Tailored offer

- We will respond within 48 hours and schedule an online meeting.

- We will prepare a tailored offer based on your company’s needs.

Available capital in your account

- Signing the necessary documents.

- We can release part of the capital immediately if needed, or after completing the employee onboarding process.

Contact us

- How many full-time employees do you have (excluding temporary workers and contractors)?

- What are your costs for net wages?

- Are you interested in stable or seasonal financing?

Tailored offer

- We will respond within 48 hours and schedule an online meeting.

- We will prepare a tailored offer based on your company’s needs.

Available capital in your account

- Signing the necessary documents.

- We can release part of the capital immediately if needed, or after completing the employee onboarding process.

Get the most convenient capital

Write to us and we’ll prepare a tailored offer for you.

We care about your data in our privacy policy.

Flexible financing for your business.

Flexible financing for your business.

We offer stable financing or tailored cash flow that lets you time your expenses for specific months of the year. We guarantee the most competitive terms on the market.

Instant capital with flexible repayment terms.

Working capital for companies with stable cash flow. We’ll tailor the capital amount to your needs. Repay it when it works best for you.

Ideal for companies with stable cash flow

For companies seeking stable capital without the need to plan cash flow around specific times of the year.

Annual interest rate: 4–10%

We guarantee the most competitive terms on the market. The interest rate depends on your company’s profile, capital amount, and funding duration.

No debt burden

WageNow financing is classified as a short-term claim. It does not affect your existing credit terms or borrowing capacity.

Vhodné pre firmy

so stabilným cashflow

Pre firmy, ktoré hľadajú stabilný kapitál a nevyžadujú plánovanie cashflow na konkrétne obdobie v roku.

Ročný úrok od 4%

Firmám garantujeme najvýhodnejšie podmienky na trhu. Výška úroku je závislá od parametrov firmy, objemu kapitálu a dĺžky uvoľnenia.

Bez dlhového zaťaženia

WageNow financovanie je kategorizované ako krátkodobá pohľadávka. Neovplyvňuje teda vaše existujúce úverové podmienky a kapacitu.

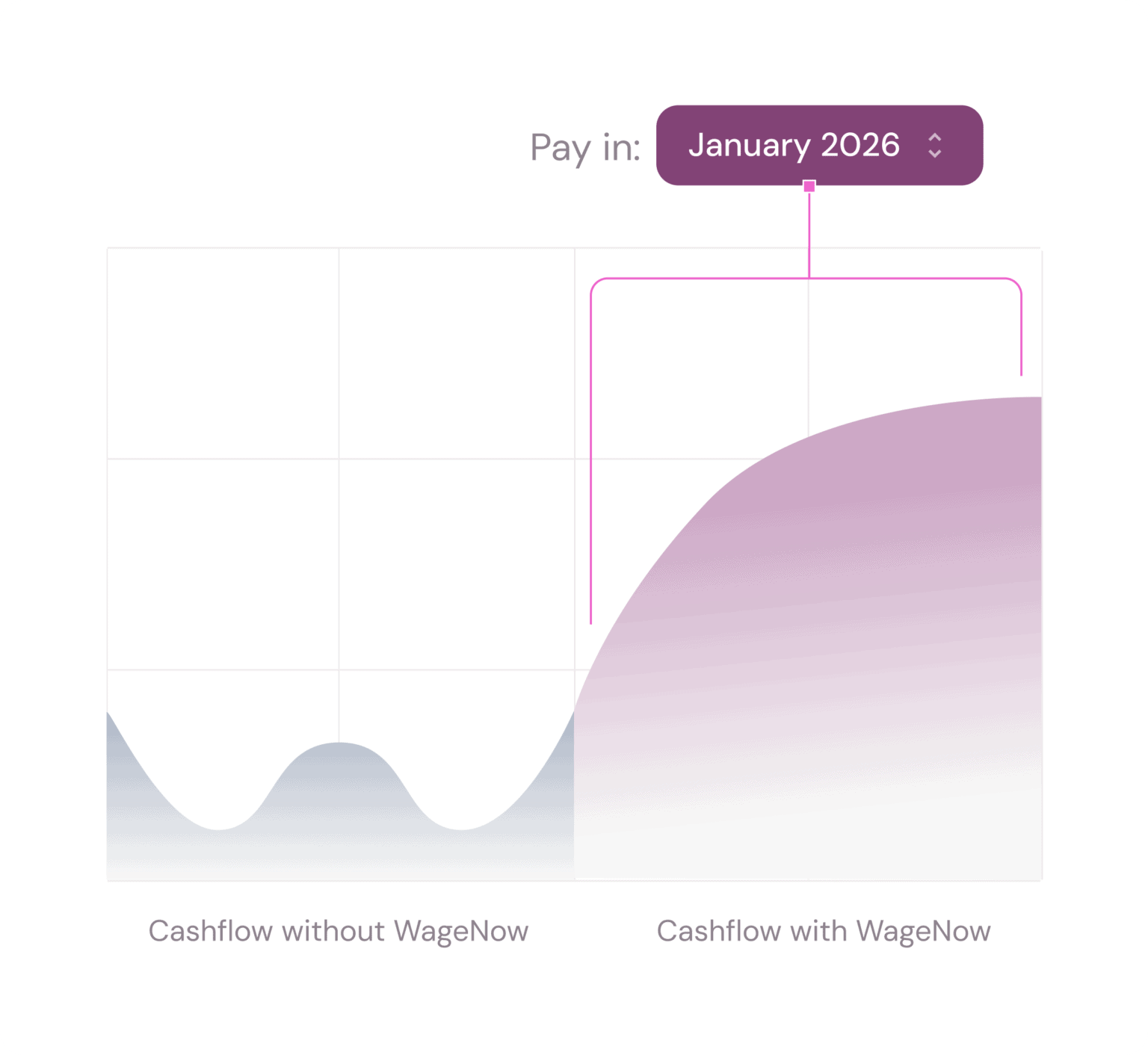

Smart cash flow solutions for your seasonal business

Do you have unstable cash flow? We will prepare a custom financing schedule for the agreed period of the year, tailored to your needs.

Tax optimization and cost savings

By deferring payroll, you also delay tax payments, enabling tax optimization and reducing additional costs.

Annual interest rate: 4–10%

We guarantee the most competitive terms on the market. The interest rate depends on your company’s profile, capital amount, and funding duration.

No debt burden

WageNow financing is classified as a short-term claim. It does not affect your existing credit terms or borrowing capacity.

Optimalizácia daní

a šetrenie nákladov

Posunutím miezd posúvate aj platenie daní, čo vytvára daňovú optimalizáciu a šetrí ďalšie náklady.

Ročný úrok od 4%

Firmám garantujeme najvýhodnejšie podmienky na trhu. Výška úroku je závislá od parametrov firmy, objemu kapitálu a dĺžky uvoľnenia.

Bez dlhového zaťaženia

WageNow financovanie je kategorizované ako krátkodobá pohľadávka. Neovplyvňuje teda vaše existujúce úverové podmienky a kapacitu.

Get the most convenient capital.

Contact us and we’ll create a tailored offer for you.

Frequently asked questions

Financujeme mzdy zamestnancov a vyvárame tak voľný kapitál. Zamestnancom poskytujeme benefit flexibilnej mzdy.

How does WageNow financing help companies gain financial flexibility?

WageNow provides companies with immediate access to funds, freeing up capital for growth, investments, and better cash flow management.

Is WageNow financing a loan?

No, it’s not a loan. It’s short-term receivables financing that doesn’t affect your credit capacity or existing loan terms.

What types of companies is WageNow suitable for?

This solution is designed for companies with 20 to 500 employees, ideally those using digital attendance and payroll systems (though it’s not a requirement). It’s a great fit for SMEs and businesses with seasonal cash flow that need better planning for wages and taxes.

How is WageNow financing different from traditional bank loans?

Unlike banks, WageNow doesn’t require complex approvals or collateral. The financing is fast, flexible, and doesn’t impact your company’s credit capacity.

How can I apply for WageNow financing?

If you meet WageNow’s criteria and are interested in our financing, contact us via email or phone. We’ll be happy to introduce a solution tailored to your company’s needs.